Subscribe to our Great Stuff™ emails and receive info that makes your projects great.

Original dispenser

- Convenient, disposable straw

- Flexible nozzle fits in hard-to-reach places

Smart Dispenser™

- No-drip dispensing for less mess

- Reusable up to 30 days

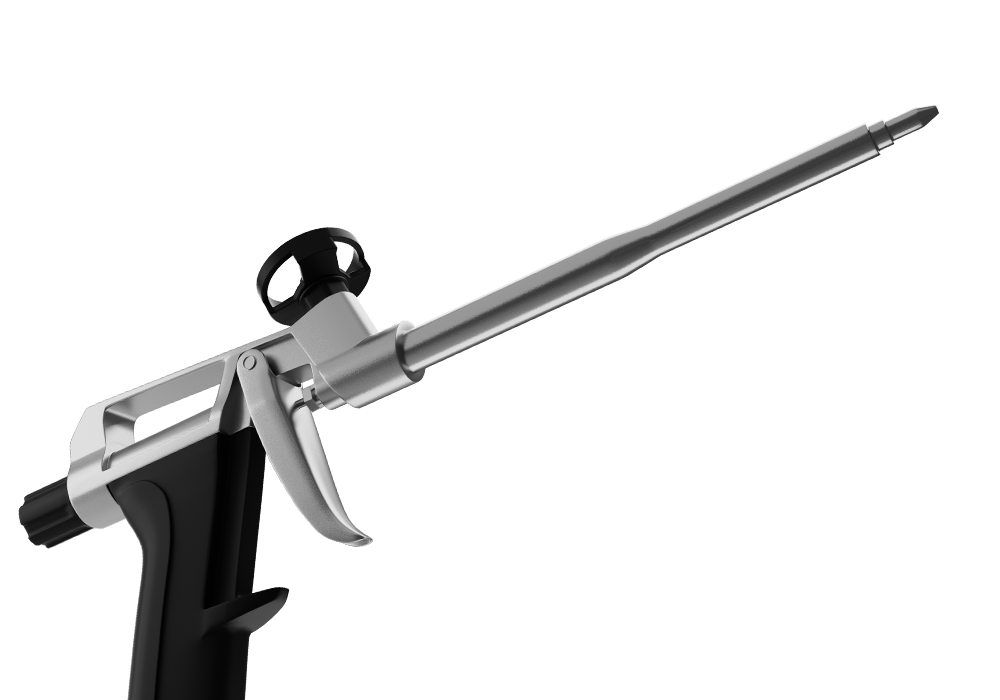

PRO DISPENSING GUN

- Flow-control mechanism dispenses beads from 1/8” to 3”

- Lightweight, high-strength aluminum body with a metal trigger

- Works with all GREAT STUFF PRO™ cans

- No-drip dispensing

- Greater precision and access to hard-to-reach areas

When the day calls for great

We engineer energy-saving sealant products that do more than fill spaces. They meet the needs of people who want to take care of their stuff as thoroughly, precisely, and simply as possible. Which means fewer re-do’s and more high-fives. For pros and DIYers aiming to block out air, water, pollen, or pests the right way, good never fills in for great. Learn More About Great Stuff™